10 AUG 2018

The United Nations (UN) ushered in a set of Sustainable Development Goals (SDGs) in 2015, setting off a flurry of activities targeting at the SDGs. The financing needs to achieve the SDGs by 2030 is huge and challenging. A 2018 report released by the UN Development Programme estimates the investment needs to eradicate extreme poverty in all countries to be around USD 66 billion annually, and investment needs for infrastructure (e.g. water, agriculture, energy, transportation) to be between USD 5 and 7 trillion annually.

More and more private and public sector investors start using an impact lens to deploy some of their capital, conscious of their responsibility and the roles they can play to close the large financing gap.Innovative finance is not a new concept, financing mechanisms such as debt-for-nature swaps have been implemented decades ago to help countries address their environmental issues. While it is not new, thereis still no single, widely accepted definitionof “innovative finance”currently in use. At iGravity, we define innovative finance as ‘a set of financial solutions and mechanisms that create scalable and effective ways of channeling both private money from the global financial markets and public resources towards solving pressing global problems’. In a 2014 report sponsored by the Citi Foundation, titled “Innovative Financing for Development: Scalable Business Models that Produce Economic, Social and Environmental Outcomes”, it was estimated that innovative financing initiatives have mobilized USD 94 billion in capital between 2000-2013.

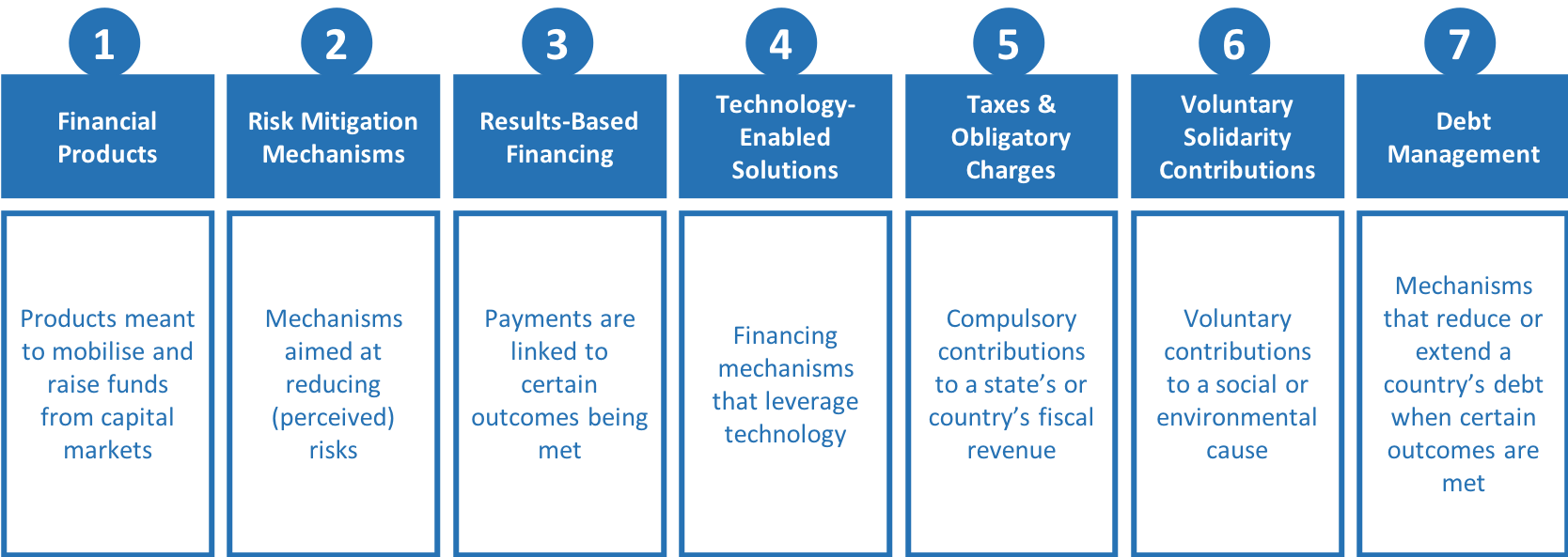

In recent years, many types of innovative financing mechanisms have been developed and used to mobilize more capital towards developmental goals. As shown in the figure below, innovative financing mechanisms can be broadly categorised into seven categoriesbased on their key attributes and main goals, i.e. mobilizing funds from capital markets(e.g. bonds, impact investment funds), mitigating risks(e.g. guarantees, insurance), linking payments to results(e.g. Development Impact Bonds, outcomes-based funds), and leveraging technology(e.g. crowdfunding, blockchain). The last three categories involve country-level intervention to mobilize funding (e.g. taxes and obligatory charges, voluntary contributions, or sovereign debt).

Some of these innovative financing mechanisms are already mobilizing a substantial amount of private capital and there is huge potential for the public sector to leverage these mechanisms even further and direct capital more efficiently towards achieving the SDGs. For instance, impact investing alone has over USD 228 billion of assets under management as reported in the latest GIIN Annual Impact Investor Survey 2018. Some of these investment funds are structured into multiple tiers of capital layers (or “blended”) to attract private sector capital where risk-return profile is sub-optimal. Public sector can provide cornerstone investments or take up different risk positions in such funds, essentially lowering the risk for private sector investors.

Another mechanism that is gaining ground recently is the Development Impact Bond (DIB). In a DIB, private sector investors provide upfront capital to service providers or implementers to fund the implementation of programs, which will be repaid by outcome funders when pre-agreed outcomes are attained.The implementers and service providers have the flexibility to decide how they wish to use the upfront capital to design and implement programs that can best achieve the pre-agreed outcomes.

At iGravity, we work with different Non-Governmental Organizations and International Organizations to assess feasibility of and design innovative financing mechanisms that can best combine various resources and competencies to achieve greater impact. The development of an innovative financing initiative takes time and typically involves cultivating awareness and understanding of innovative finance within an organization, conceptualising the theory of change, setting goals, searching for and onboarding of the right partners, as well as negotiating a common position and vision among the various parties on the target outcomes and ways of achieving them.

While it is not a simple process, innovative financing, once done properly, can build unusual but powerful partnerships and attain results that traditional funding can never achieve alone. Recently at the 2018 G7 Summit, the leaders committed, among others, to “support innovative financing approaches to achieve greater sustainable development outcomes and unlock resources, such as crowdfunding, blended finance, risk mitigation tools, and investor partnerships”.There is much more to be done, and with continued commitment and interest from the leaders globally, we expect to see more private, social and public sector players coming together to address the SDGs with innovative financing initiatives in the years to come.

By Eileen Zhang