28 JAN 2021

Demand for sustainable investments has skyrocketed in the last years. While ESG investing has arrived in the mainstream, impact investing is still a niche. Growth rates are staggering though. In Switzerland, the sum in impact investments tripled in 2019 according to the Swiss Sustainable Finance Association. And while 2020 numbers are not out yet, they are expected to have continued to grow steadily in spite of the pandemic.

In such a quickly growing market, it is not always easy to separate the wheat from the chaff. After all, there is a lot of impact washing going on. Some managers use “impact investing” as a marketing label, without rigorously measuring the impact of their investments and documenting additionality considerations. This is why iGravity launched the Impact Investment Index, guaranteeing rigorous due diligence and impact evaluation, but without compromising on financial yield. The annual gross return is projected to be four to six percent over a three to five-year period.

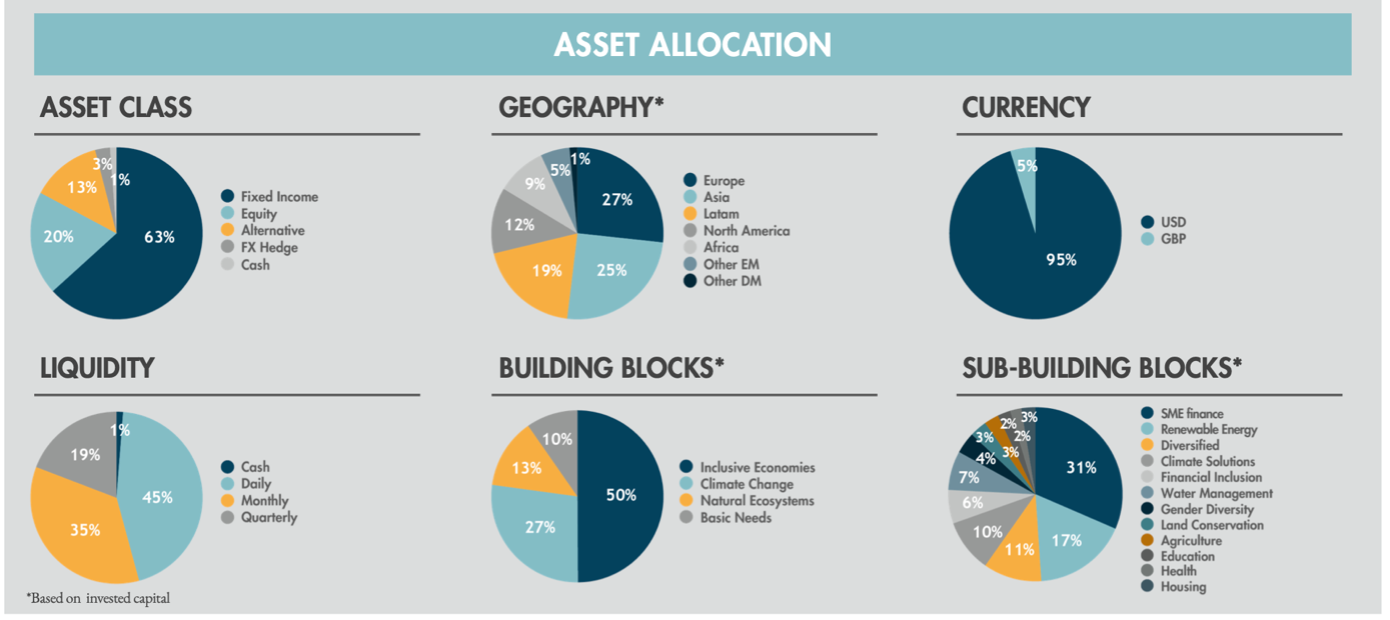

“Our index unites fifteen to twenty positions that contribute to improving livelihoods of people, supporting businesses and help protecting our environment”, says portfolio manager Eugenia Martini Donati. The index is diversified across asset classes, geographies, and impact themes (see graph). To reach a diversified portfolio from a risk and from an impact perspective, the index holds positions on microfinance and SME financing strategies, investments in renewable energy such as green bonds and products providing access to quality education to students from emerging markets.

“We have translated the U.N. Sustainable Development Goals (SDGs) into four investment priorities: Basic Needs, Inclusive Economies, Natural Ecosystems and Climate Change Mitigation”, explains Eugenia. Of these four building blocks, the one on Inclusive Economies has the biggest weight at the moment. It funds several asset managers who provide credit to small and medium-sized enterprises (SMEs) in developing markets.

Investing catalytic capital into the “missing middle”

Especially in low-income countries, SMEs find it difficult to raise capital to grow their operations. They are too big for micro-loans and too risky for commercial banks. Mostly, they lack a formal credit history and collateral. Therefore, they struggle to get access to funding.

The World Bank estimates that more than half of the 300 million SMEs in emerging markets do not have access to credit despite the need for it. “Here, the impact investments that flow through our index make a huge difference – enabling innovators and entrepreneurs to create jobs and a better future for themselves and their communities”, says Eugenia.

Stories like the one from the Ghanaian trader Matilda Oduro show how a small amount of money can catalyse big improvements. After three decades of trading traditional costumes, Matilda’s business took flight when she started taking up loans through one of iGravity’s microfinance investment managers. She used her first loan to buy inventory and two subsequent loans to further expand her business. Today, she does not only lease the building next door to her original shop, but she can also afford to send her oldest son to university.

“Of course, stories like Matilda’s are inspiring. But we are not satisfied with anecdotical evidence”, says Eugenia. “We do very strict due diligence processes with the positions in the index. If something glitters from the outside but is rusty in the inside, we will find out soon”, she adds.

Comparing impact investments in one single database

To be able to identify the best-in-class impact investments from a financial and an impact point of view, the iGravity team has been building a database with more than 600 investment opportunities and a proprietary impact assessment tool inspired by international standards such as the Impact Management Project and IRIS+. “With this tool, we can compare a wide range of currently available impact investment opportunities”, says impact analyst Anne Katrine Buch Vedstesen.

But even though the database helps iGravity to make evidence-based investment decisions, the tool opens a series of new, complex questions. “How do you select the most impactful product if you have the choice between an investment that avoids 100 tons of CO2-emissions on the one side, and one that sends an additional child to school on the other?”, asks Anne Katrine.

“It is tempting to reduce the impact of an investment opportunity to a score to make it comparable across impact themes and sectors. However, impact is highly multifaceted and contextual. For this reason, we have divided the impact investing universe into peer-groups consisting of comparable products from an impact perspective”, explains Anne Katrine. “So, we have a renewable energy peer-group and a SME-finance peer-group for example. This allows us to compare the impact and the impact efficiency – meaning impact per dollar invested – of one product against its true peers. This is how we choose the best-in-class products from an impact perspective.”

“Additionally, we have constructed the index in such a way that it depicts the wider impact investing market”, adds portfolio manager Eugenia. “That has a very practical side effect: the index serves as a benchmark of the whole impact investing sector.”

Mobilize finance from the private sector

“The goal of the index is to help attract private sector money to development”, says Patrick Elmer, founder and managing director of iGravity. After all, prior to the effects of Covid19 there was a 2.5 trillion USD wide annual investment gap to achieve the UN Sustainable Development Goals. UNDP estimates that this gap has now increased to 4.2 trillion USD. “This gap can only be closed with private finance. And most private actors only invest if we deliver on both impact and returns”, he adds.

This is why the portfolio manager can list the impact of the index at any moment: “As of December 2020, our portfolio companies distribute more than 20 million litres of drinkable water per year, avoid almost 2.5 thousand tonnes of CO2-eq emission per year and, at this moment, they protect or sustainably manage more than 3 thousand hectares of land while others provide finance to more than 700 MSMEs of which 60% are female-owned and 56% are based in rural areas”, says Eugenia.

The more money committed to the index, the more impact it will generate. Or, how portfolio manager Eugenia Martini Donati puts it: “If you work towards a goal like a more inclusive and sustainable world, even stuff like fundraising becomes fun.”

If you want to know more about the iGravity Impact Investment Index, please contact Portfolio Manager Eugenia Martini Donati (eugenia.donati@igravity.net).

Author: Gioia da Silva, independent storyteller and communications advisor