17 FEB 2021

Being a notoriously discriminated group, many lesbian, gay, bisexual, trans, intersex and queer entrepreneurs face big obstacles when they try to raise capital to grow their businesses. Dreilinden, a Hamburg-based foundation dedicated to advancing societal acceptance of gender and sexual diversity, has published an insightful blog series about their impact investment strategy in the Global South and East.

When they approached iGravity in 2018, Dreilinden already had a broad understanding of the societal factors and the political landscapes that limit the growth of LGBTQI+ enterprises. “We’ve translated their deep knowledge about structural discrimination into an investment lens, that allows Dreilinden to finance mission-aligned entrepreneurs”, says Anne Katrine Buch Vedstesen, Impact Analyst at iGravity.

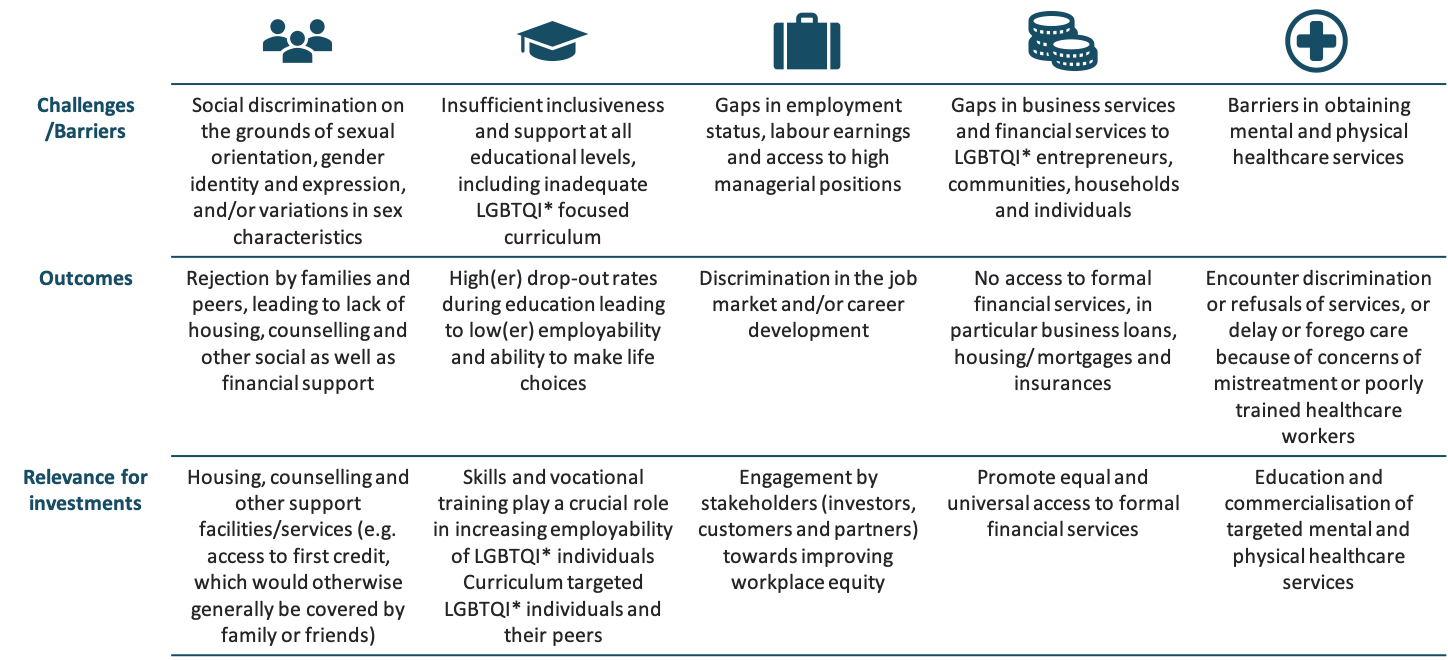

Illustrative example of relating barriers and challenges to potential investment areas.

Illustrative example of relating barriers and challenges to potential investment areas.

But how can you build an investment framework based on things as different as effective non-discrimination workplace practices and lack of appropriate health services for a group that is so widely dispersed as the LGBTIQ+ communities in emerging economies?

“Departing from a Theory of Change, we identified components that indicate, whether an entrepreneur or enterprise in emerging economies address the root causes of the structural issues“, replies Anne Katrine. “To do this, we need to understand not only the social, political, and economic context of a company, but also the systemic barriers that hinder investments from flowing into otherwise growth-ready companies. This requires both general knowledge about Start-up and SME financing in the target regions and a deep understanding of the particular barriers experienced by LGBTQI+ entrepreneurs.”

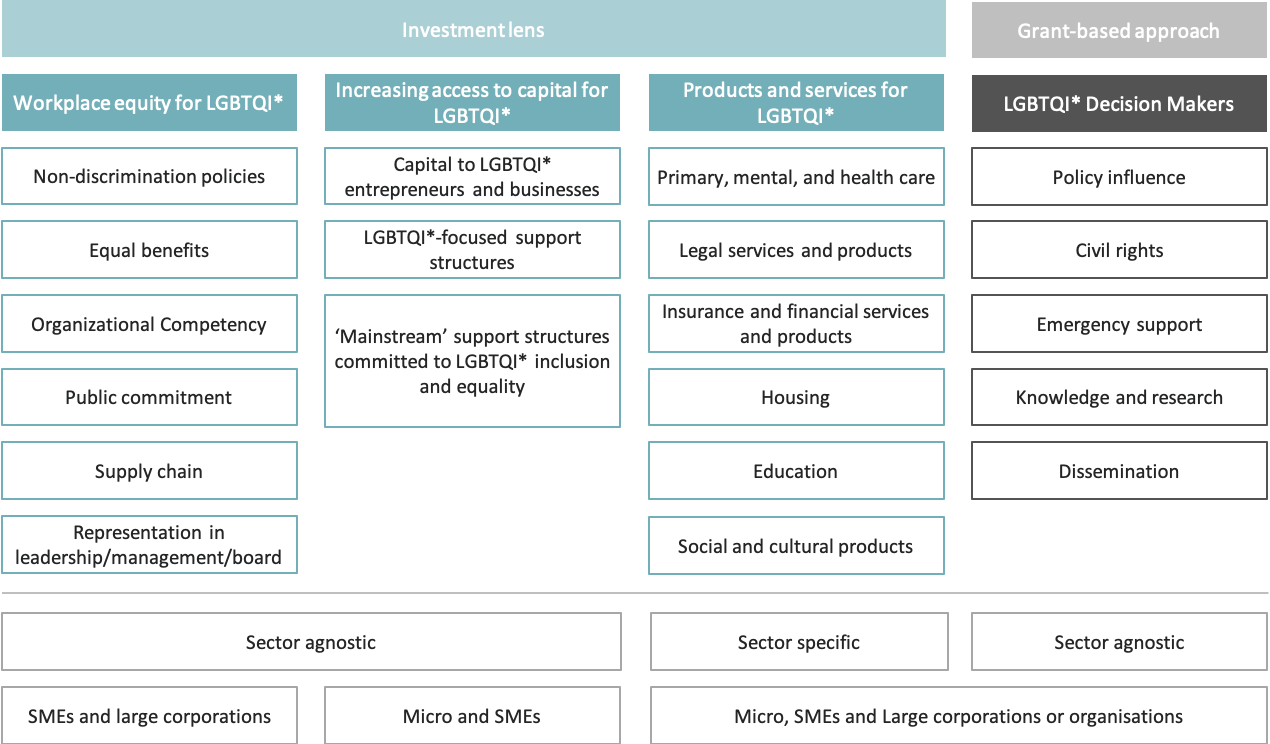

Overview of investment lens

Overview of investment lens

Identify investable deals

Guided by an investment lens, iGravity can help mission-driven impact investors build a pipeline of potential investment opportunities in their target geographies and sectors. Thereby, potential investors can gain an early understanding of the characteristics, investability and investment-readiness of the target enterprises. “Finding investment-ready companies that address certain Sustainable Development Goals can be tricky. Guided by the investment lens, we usually start from scratch with an online search for companies through relevant networks, associations and industry bodies. However, the amount and quality of the information available online will differ highly. In rural parts of developing countries, for example, many companies will not have a webpage. You need to tap into local networks and go on the ground to find them”, says Lucas, Head Advisory & Partnerships at iGravity.

For pipeline building, iGravity typically identifies 40 to 100 social enterprises per investment lens and geography to create a long-list of illustrative opportunities.These companies are screened and prioritised based on a proprietary framework with pre-defined criteria, such as fit with the impact objective, potential for scale and maturity stage. For the short-list, iGravity typically selects the 20 to 30 most promising companies and analyses them from a financial and an impact perspective in the due diligence process.

“Using our survey-tool, we systematically gather information about the companies, including their financial and non-financial needs, which help us identify the appropriate investment vehicles and technical assistance to meet the needs of the final deal-book consisting of 5-10 companies”, explains Lucas. From there, it typically takes between three to six months per company to finalise the due diligence, investment agreement and impact management plan. Using this procedure, iGravity delivered three deal-books with five investment-ready companies to Dreilinden, listing LGBTQI+ firms in South Africa, Slovakia and Poland.

Designing investment lenses for any mission

“The Dreilinden project is a good example of how foundations can align their investment strategies to their values. Using the same methodology, we can design a specific investment lens for almost any mission: providing nutritious food to school children, improving agricultural practises for smallholder farmers, bringing healthcare services to underserved rural populations – you name it”, says Anne Katrine.

Something that often comes up in the process of building a themed investment lens for a foundation, is the balance between grant giving and impact investments. “Investments and grants complement each other. Some root causes of poverty and inequality are better addressed through grants, others are more effectively and efficiently tackled through investments.”

If you would like to know more about mission-driven impact investment lenses, you may contact Anne Katrine Buch Vedstesen, Impact Analyst at iGravity. (annekatrine.vedstesen@igravity.net).